Independent businesses face growing pressure from rising operating expenses and the need to meet customer expectations for seamless and efficient service. That’s where Savings4Members steps in, connecting businesses with trusted vendor partners like Fiserv (formerly CardConnect AIP). Through this partnership, businesses gain access to reduced processing fees, advanced security features, real-time reporting, and seamless integration with ERP and POS systems. This allows businesses to focus on their core operations, save money, and thrive in a competitive marketplace.

Saving Money on Processing Fees

For small businesses, every dollar spent on processing fees is a dollar that could otherwise be invested in growth. Credit card processing fees can be especially challenging, as they eat into profit margins and add unnecessary expenses. Fiserv (formerly CardConnect AIP) helps businesses significantly reduce these costs by analyzing their current processing environment and identifying inefficiencies. By offering customized solutions, CardConnect AIP ensures that businesses only pay for the services they need.

Fiserv (formerly CardConnect AIP) also provides businesses with clear, transparent pricing structures that help them avoid the hidden fees often associated with other payment processors. This transparency enables businesses to make better financial decisions, while their savings can be redirected toward more strategic initiatives like expanding product lines or enhancing customer experience.

Advanced Security Features

Security is a major concern for businesses dealing with sensitive customer information. Fiserv (formerly CardConnect AIP) addresses these concerns head-on by utilizing advanced security technologies that protect both the business and its customers. One of Fiserv’s standout features is its tokenization technology, which replaces sensitive cardholder data with unique identifiers, significantly reducing the risk of fraud and data breaches. This means that even in the event of a system compromise, the actual card information remains protected.

In addition to tokenization, Fiserv (formerly CardConnect AIP) offers built-in compliance tools to ensure businesses meet industry standards like PCI DSS (Payment Card Industry Data Security Standard). These tools streamline the often-complex process of ensuring compliance, reducing the burden on small business owners and providing peace of mind. By adopting Fiserv’s security features, businesses can safeguard their reputation and maintain customer trust, which is crucial in a highly competitive market.

Real-Time Reporting for Better Decision-Making

Real-time access to payment data is invaluable for making informed business decisions. Fiserv’s platform offers businesses real-time reporting, giving them the tools to monitor transaction activity as it happens. Whether tracking daily sales trends, evaluating payment method performance, or identifying areas where costs can be cut, real-time reporting helps businesses stay on top of their financial health.

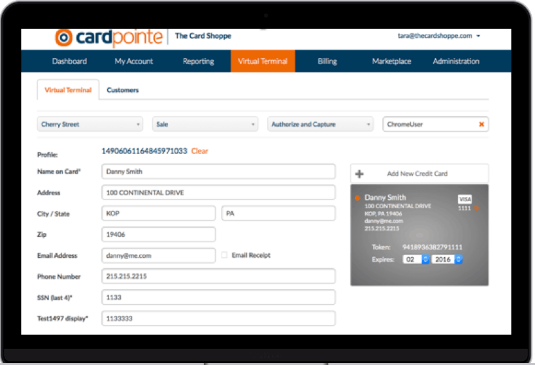

Fiserv’s CardPointe platform offers easy-to-read, customizable reports that provide detailed insights into a variety of key metrics, including transaction volume, revenue, and payment costs. This immediate access to actionable data means that business owners don’t have to wait until the end of the month to evaluate their performance. By utilizing this data, they can make quicker adjustments to their strategy, optimize operations, and improve overall profitability.

With Fiserv’s real-time reporting, business owners can move from reacting to proactively planning for growth. This insight into payment trends can also help businesses optimize their customer service, identify popular products or services, and plan for seasonal demand fluctuations.

Seamless ERP and POS Integrations

For independent businesses, operational efficiency is key to staying competitive. Many businesses rely on ERP (Enterprise Resource Planning) and POS (Point of Sale) systems to manage a variety of tasks, from tracking inventory to managing customer relationships. Fiserv (formerly CardConnect AIP) enhances these systems by offering seamless integration with most major ERP and POS platforms. For instance, Fiserv is compatible with Epicor Eclipse, P21, & DDI.

These integrations streamline the entire process by automatically syncing payment data with other business management tools. For example, sales data from the POS system can be automatically updated in the business’s accounting software, reducing the need for manual data entry and eliminating the risk of errors. By integrating payment processing with their ERP and POS systems, businesses save time, reduce administrative overhead, and ensure accuracy across their operations.

Additionally, Fiserv’s flexibility allows businesses to tailor integrations to their specific needs. Whether it’s adding customized reporting features or linking with a specialized accounting tool, Fiserv’s platform adapts to the business’s unique workflows, enhancing overall efficiency and allowing business owners to focus more on growth and customer service.

Part of a Network of Trusted Partners

Fiserv (formerly CardConnect AIP) is just one of the many reliable vendor partners that members have access to through Savings4Members. These partnerships offer businesses access to a wide range of services—from shipping discounts to fuel savings and beyond. By being part of the Savings4Members network, businesses can tap into exclusive deals and resources that are typically out of reach for smaller operations.

Savings4Members negotiates special pricing and services with its vendor partners, using the collective buying power to secure better rates for members. This means that independent businesses can benefit from the same competitive advantages that larger corporations enjoy without having to sacrifice their autonomy or scale.

Through Savings4Members, Fiserv and other vendor partners become an extension of the business, helping them tackle everyday challenges with high-quality, cost-effective solutions. These partnerships not only help businesses save money, but also ensure they have access to the tools and expertise needed to grow and succeed.

Building Value for Independent Businesses

Savings4Members is more than just a network of vendor programs—it’s a strategic partner for businesses looking to optimize their operations and drive sustainable growth. By offering access to solutions like Fiserv (formerly CardConnect AIP), Savings4Members equips its members with the resources they need to overcome obstacles and thrive in competitive markets.

For Savings4Members participants, the value goes beyond cost savings. It’s about simplifying operations, improving security, and accessing specialized expertise to level the playing field. Whether through lower processing fees, enhanced fraud protection, or the seamless integration of payment systems, every vendor partnership within the Savings4Members ecosystem adds tangible value to independent businesses.

As independent businesses continue to evolve, leveraging partnerships like those with Fiserv (formerly CardConnect AIP) will be key to their long-term success. By taking advantage of Savings4Members’ extensive network, businesses can stay ahead of the curve, save money, and build resilience in an ever-changing marketplace.

To learn more about your member benefits, visit savings4members.com/contact-us.